Czech payroll calculator

Ad Process Payroll Faster Easier With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

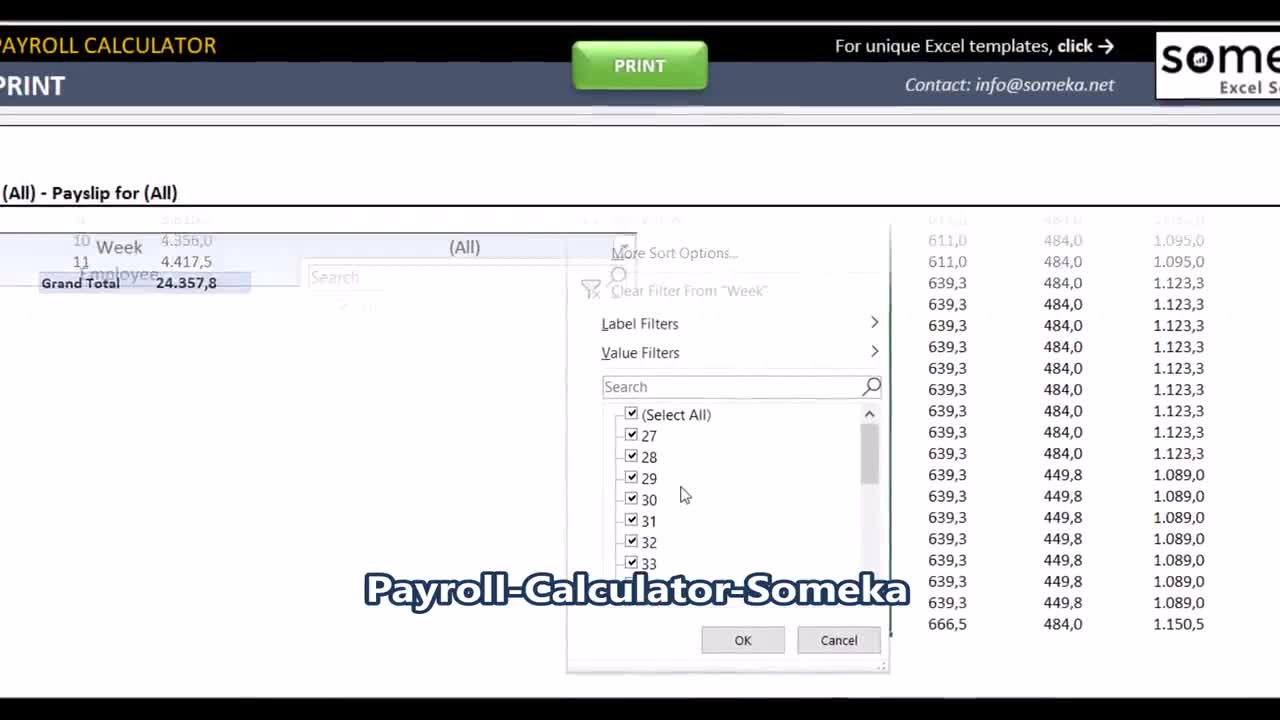

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees.

. We hope these calculators are useful to you. Net Salary calculator for Czech Republic Annual gross income Kč. In 2016 the average hourly wage in the Czech Republic was 1020 1207 - compared to the average EU wage of 2540.

The Czech Republic tax calculator assumes this is your annual salary before tax. When you choose SurePayroll to handle your small business. Free Unbiased Reviews Top Picks.

A high percentage of the Czech workforce is. Freelance payment calculator See what. By accurately inputting federal withholdings allowances and any relevant.

If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the. Calculate Freelancers net income. Federal Salary Paycheck Calculator.

Czech Salary 2022 home Home info About attach_money Calculate Freelancers net income. Free Unbiased Reviews Top Picks. Below you can find out what youll earn and owe while living in the Czech Republic as well as what you can receive if you require Materinity leave.

The employee must take a minimum of 14 weeks. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Discover ADP Payroll Benefits Insurance Time Talent HR More.

State your gross annual salary and set your desired currency. Specify your tax class where necessary. In the Czech Republic a woman is entitled to 28 weeks of maternity leave 37 weeks for multiple births.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information. Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More.

200 000 CZK 155 644 CZK 15 tax rate 44 356 CZK 23 tax rate amount over limit 155 644 x 15 23 346 CZK 44 356 x 23 10 201 CZK 33 547 CZK 3 000 CZK credit. There are two types of Czech freelance tax rates - 15 and 23. The rate is 23 on clean income exceeding 1 867 728.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Important note on the salary paycheck calculator. Ad Process Payroll Faster Easier With ADP Payroll.

So your income tax could be at a rate of 15 on your clean income. Get Started With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Calculation of net salary in Czech. If payroll is too time consuming for you to handle were here to help you out.

Payroll Calculator Excel Template To Calculate Taxes And Etsy Canada

Annual Bi Weekly Timecard Payroll Calculator Etsy

Czech Net Salary Calculator 2016 Company Salaries

Czech Republic Hourly Rate Tax Calculator 2022 Hourly Rate

Payroll Stock Photos Royalty Free Payroll Images Depositphotos

Supergross Gross And Net Salary In The Czech Republic Pexpats

Czech Tax Return Tax Deductions And Discounts You Should Know About

Payroll Time Conversion Chart Payroll Calculator Conversion Chart

2022 Payroll Calculator For The Czech Republic Accace Outsourcing And Advisory Services

Net Salary Calculation Salary Calculator 2022 Platy Cz

2022 Payroll Calculator For The Czech Republic Accace Outsourcing And Advisory Services

Labour Law Consulting Accace Outsourcing And Advisory Services

Payroll Calculator Excel Template To Calculate Taxes And Etsy Ireland

Equivalent Salary Calculator By City Neil Kakkar

Czech Gross Net Salary Calculator 2022 2023 Pragueexpats

Payroll Calculator Excel Template To Calculate Taxes And Etsy Canada

Average Salary In Czech Republic 2022 The Complete Guide